prince william county real estate tax lookup

Prince William County Deputy Finance Director Tim Leclerc in a letter to county officials estimated the proposed PW Digital Gateway would eventually generate about 4005 million in local tax revenue annually under current tax rates not the 700 million the projects applicants estimate. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.

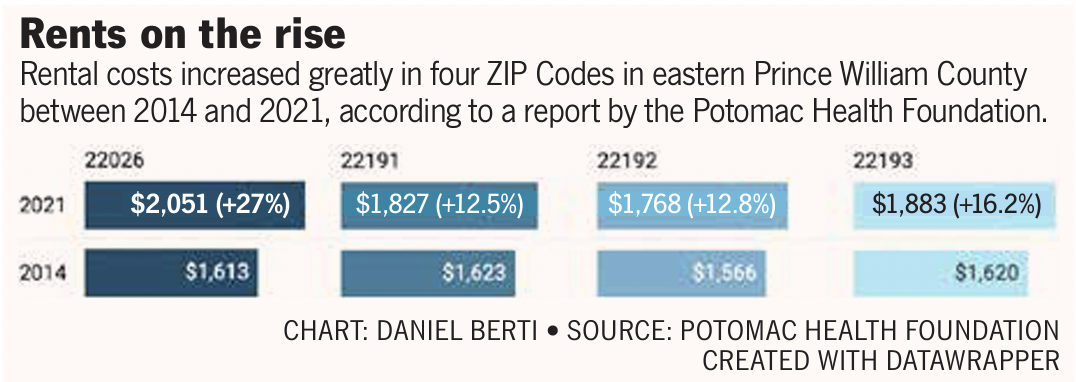

Report Rents Rapidly Increasing In Eastern Prince William News Princewilliamtimes Com

Enter the house or property number.

. Copies of subdivision plats are available for purchase at the Clerk of Circuit Court Land Records located at 9311 Lee Avenue 3rd Floor Manassas VA 20110. Click here to register for an account or here to login if you already have an account. Report a Vehicle SoldMovedDisposed.

Prince William County Real Estate Assessor. City of Manassas Park eg. Prince William County - Home Page.

Their phone number is 703 792-6035. Ad Uncover Available Property Tax Data By Searching Any Address. Houses 1 days ago Prince William County Real Estate Tax Search.

If your account numberRPC has less. When prompted enter Jurisdiction Code 1036 for Prince William County. Searching by name is not available.

The AcreValue Prince William County VA plat map sourced from the Prince William County VA tax assessor indicates the property boundaries for each parcel of land with. Expert Results for Free. Neither the Prince William County offices nor the Courthouse keep copies of individual house location surveysplats.

Prince William County Real Estate Tax Map. If you have questions about this site please email the Real Estate Assessments Office. Have pen paper and tax bill ready before calling.

Prince William County Virginia Home. -- Select Tax Type -- Bank Franchise Business License Business. Land Records are maintained by various government offices at the local Prince William County.

No part of this fee goes to the County. Tax Map 37-2-63 Contact the Real Estate Assessor at 703-335-8811 or the Commissioner of Revenue at 703-335-8825 or visit the Manassas Park websiteCounty of Prince William eg. AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books.

Easily Find Property Tax Records Online. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office. Report a New Vehicle.

Press 1 for Personal Property Tax. Report changes for individual accounts. Post your land listings on AcreValue.

You can pay a bill without logging in using this screen. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. Enter street name without street direction NSEW or suffix StDrAvetc.

Just Enter Your Zip for Free Instant Results. Contact us to learn more. Report a Change of Address.

Account numbersRPCs must have 6 characters. Use both House Number and House Number High fields when searching for range of house numbers. Effective tax rate Prince William County 00105 of Asessed Home Value Virginia 00082 of Asessed Home Value National 00114 of Asessed Home Value Median real estate taxes paid Prince William County 4010 Virginia 2234 National 2471 Median home value Prince William County 382400 Virginia 273100 National 217500 Median income.

You may view the 2022 assessments via the online Real Estate Property Assessment System. These records can include land deeds mortgages land grants and other important property-related documents. We Provide Homeowner Data Including Property Tax Liens Deeds More.

Prince William County Tax Warrants Report Link. Follow These Steps to Pay by Telephone. Press 2 for Real Estate Tax.

Houses 4 days ago Homes Details. 4379 Ridgewood Center Drive Suite 203 Prince William VA 22192. The Assessments Office will mail the 2022 assessment notices in early March.

Than 6 characters add leading zeros to it before searching. By creating an account you will have access to balance and account information notifications etc. Ad Find County Property Tax Info For Any Address.

You will need to create an account or login. Prince William County Land Records are real estate documents that contain information related to property in Prince William County Virginia. Get Record Information For Any Address About Any County Property.

If you are searching by gpin please enter it in the following format. 5 days ago Search Prince William County property tax and assessment records including sales search and parcel history by owner name or address. Ad Just Enter your Zip Code for Property Tax Records in your Area.

Class Specifications Sorted By Classtitle Ascending Prince William County

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

Prince William Supervisors To Take Up Tax Rate Tuesday Wtop News

New Prince William Deputy County Executive Of Public Safety Announced

Prince William School Calendar Fill Online Printable Fillable Blank Pdffiller

Report Rents Rapidly Increasing In Eastern Prince William News Princewilliamtimes Com

Market Statistics Realtor Association Of Prince William

Where Residents Pay More In Taxes In Northern Va Wtop News

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Police Basic Recruit School Graduates Today

Report Rents Rapidly Increasing In Eastern Prince William News Princewilliamtimes Com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

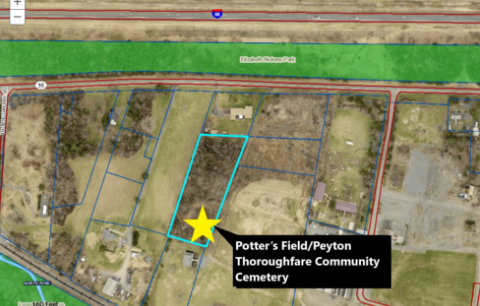

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

The Summer Is Looking Bright In Prince William County Parks Recreation